Switching Health Plans: How to Evaluate Generic Drug Coverage to Save Money

- Colin Hurd

- 18 February 2026

- 0 Comments

When you switch health plans, one of the biggest surprises isn’t the premium-it’s the cost of your generic drugs. You might be paying $5 a month for your blood pressure medication now, only to find out next year it’s $45 because your new plan put it in a higher tier. Or worse, it’s not covered at all. This isn’t a glitch. It’s how formularies work. And if you don’t check them before switching, you could end up paying thousands more per year.

What Are Formulary Tiers, and Why Do They Matter?

Every health plan has a list of approved drugs called a formulary. But not all drugs are treated the same. They’re split into tiers, and each tier has a different price tag. The lower the tier, the cheaper your out-of-pocket cost. Tier 1 is almost always reserved for generic drugs. These are the same as brand-name medications but cost 80-90% less. In 2022, generics made up 84% of all prescriptions filled in the U.S., yet they accounted for just 14% of total drug spending. That’s because they’re cheap-and plans want you to use them. But here’s the catch: not all Tier 1 drugs are equal. Some plans charge $3 for a 30-day supply. Others charge $20. Some waive your deductible for Tier 1 drugs. Others make you pay the full deductible before you even get to the copay. If you’re on a high-deductible plan, that could mean paying $1,500 before your $5 generic even kicks in.How Different Plans Handle Generic Drugs

Not all health plans are built the same. Here’s how the major types handle generics:- Marketplace Silver SPD Plans: These are the gold standard for generic drug users. They waive the medical deductible for Tier 1 drugs and charge a fixed $20 copay. If you take three generics monthly, you’ll pay $720 a year-no matter how much your other medical costs are.

- Standard Non-Silver Marketplace Plans: These often combine your medical and prescription deductibles. So if your deductible is $1,600, you pay that first-even for your $5 generic. Many people don’t realize this until they get hit with a $1,200 bill for a drug they thought was covered.

- Medicare Part D Plans: The base deductible in 2023 was $505, but most plans have lower or no deductible for generics. Preferred generics often cost $0-$10. But if your drug is on Tier 2 (non-preferred), you could pay $20-$40. And if you switch plans, your levothyroxine might move from Tier 1 to Tier 2 overnight.

- Employer-Sponsored Plans: These vary wildly. Some charge $5 for generics before the deductible. Others charge $15 after. MHBP Federal Health Plans, for example, offer $5 copays on their Basic Option but $10 on their Consumer Option. If you’re on a fixed income, that $5 difference adds up to $60 a year.

- Medicare Advantage with Drug Coverage (MA-PD): These often have lower out-of-pocket costs than standalone Part D plans. On average, users save 18% on generics. But only if you pick the right plan. Many people assume all MA-PDs are equal-until they find out their insulin copay jumped from $0 to $35.

State Laws Change Everything

Where you live can make a bigger difference than your plan choice.- In New York, most plans cover Tier 1 generics with $0 copay-no deductible required.

- In California, you pay an $85 outpatient drug deductible before generics kick in, then 20% coinsurance up to $250 a year.

- In Washington D.C., there’s a separate $350 drug deductible, with a $150 cap on specialty drugs.

What You Must Check Before Switching

You can’t just look at the plan summary. You need to dig into the details. Here’s your checklist:- Get the full formulary: Don’t trust the website’s “Tier 1” label. Download the complete list from the insurer’s website. Look for your exact drug name, strength, and manufacturer.

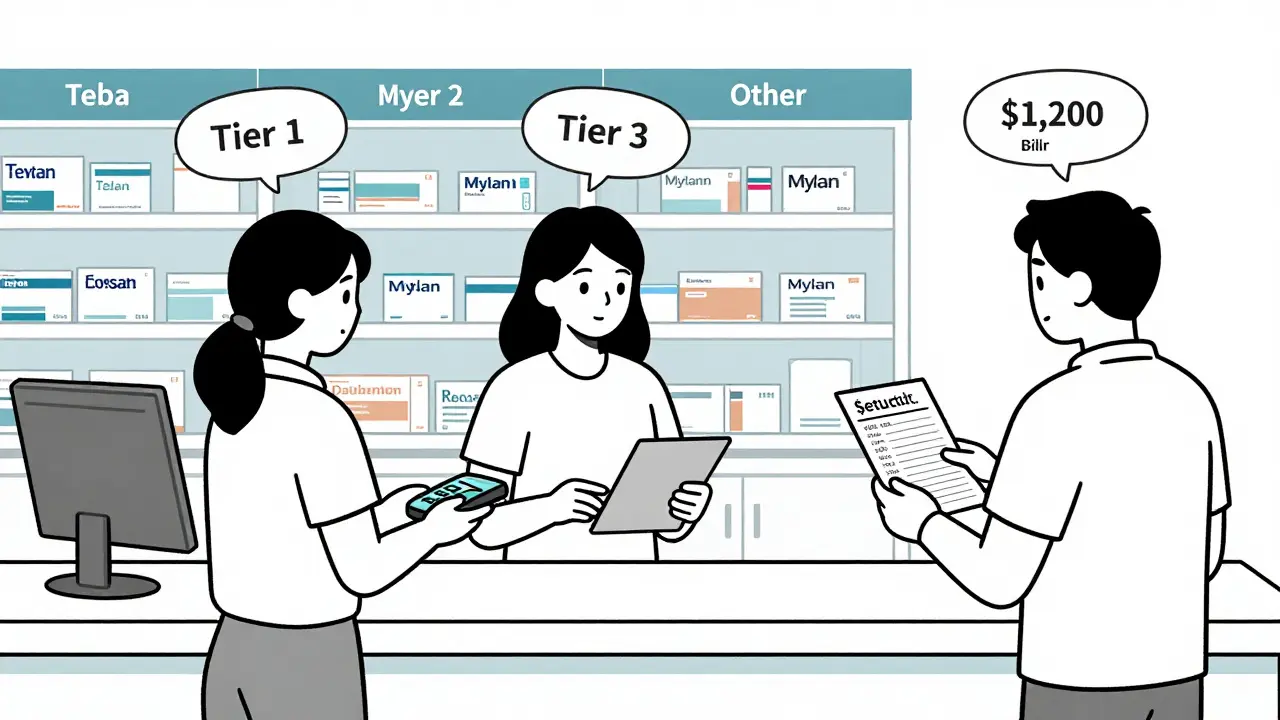

- Check the manufacturer: A generic isn’t just a generic. Metformin made by Teva might be Tier 1. Metformin made by Mylan might be Tier 2. They’re chemically identical-but plans treat them differently.

- Verify your pharmacy network: Your drug might be $3 at CVS, but $40 at Walgreens if it’s not in-network. Some plans have narrow networks that exclude local pharmacies.

- Calculate annual cost: Multiply your monthly copay by 12. Then add any deductible you’ll have to pay first. For example: $15 copay × 12 = $180 + $1,000 deductible = $1,180 total. That’s $1,000 more than a plan with a $3 copay and no deductible.

- Use a cost calculator: Medicare.gov’s Plan Finder and Healthcare.gov’s plan selector let you enter your exact drugs and see real costs. In 2022, users who used these tools had 37% fewer billing surprises.

Common Mistakes People Make

Most people think they’re covered. They’re not.- Assuming all generics are equal: A 2022 study found 68% of people switching plans didn’t check if their specific generic formulation was covered. That’s like buying a new car and assuming it comes with the same engine.

- Ignoring mail-order options: Some plans offer 90-day supplies for $10. But only if you use their mail-order pharmacy. If you stick with retail, you pay 3x more.

- Not checking for formulary changes: Plans change their formularies every year. A drug that was Tier 1 last year might be Tier 3 this year. You won’t get a letter. You have to check.

- Trusting the plan’s “low-cost” label: A plan might say “low premiums” but hide high drug costs. One Reddit user reported switching to a “budget” plan, only to pay $480 extra for their diabetes meds.

What Experts Say

Dr. Karen Pollitz from KFF says: “The elimination of deductibles for Tier 1 drugs in Silver SPD plans is the most important consumer protection since the Affordable Care Act.” She estimates it saves low-income users $1,200 a year. The Medicare Rights Center warns that 15% of seniors lose coverage for their generic meds during annual switches. Diabetes and blood pressure drugs are most likely to be dropped. And here’s a chilling stat: 41% of people pick the wrong plan because they don’t understand formulary tiers. That’s not ignorance. It’s poor design. Insurers don’t make it easy.What’s Changing in 2025

The rules are shifting fast:- Starting in 2025, Medicare Part D will cap out-of-pocket drug costs at $2,000 a year. That’s huge for people on multiple generics.

- The $35 monthly insulin cap is already in effect-and it’s working. People are filling prescriptions again.

- By 2027, 80% of marketplace plans are expected to drop integrated drug deductibles. That’s because consumers keep getting burned.

- New AI tools like CMS’s “Medicare Plan Scout” are rolling out. They predict your drug costs with 90% accuracy. Use them.

Final Advice: Don’t Guess. Verify.

Switching health plans isn’t about the monthly premium. It’s about what happens when you walk into the pharmacy. If you take even one generic drug, you need to spend 30 minutes checking your formulary. Not an hour. Not a day. Thirty minutes. Do it before open enrollment. Do it when you move. Do it when your plan sends a notice saying “formulary changes effective January 1.” Because if you don’t, you’re not saving money. You’re gambling.Are generic drugs as effective as brand-name drugs?

Yes. Generic drugs contain the same active ingredients, dosage, and strength as brand-name versions. The FDA requires them to meet the same safety and effectiveness standards. The only differences are inactive ingredients (like fillers) and packaging. Most people won’t notice any difference in how the drug works. The reason generics cost less is because manufacturers don’t have to repeat expensive clinical trials.

Why does my generic drug cost more on my new plan?

It’s likely because the plan moved your drug to a higher tier-or switched to a different manufacturer. Even if two generics have the same active ingredient, insurers treat them differently based on contracts with manufacturers. A $5 metformin from Teva might be Tier 1, while the same dose from Mylan is Tier 2 at $25. Always check the manufacturer name on your prescription label.

Do all health plans cover the same generic drugs?

No. Each plan creates its own formulary. One plan might cover all generic versions of your medication. Another might cover only one brand. Some plans exclude certain generics entirely if they have deals with brand-name makers. Always compare formularies side by side before switching.

Can I switch plans mid-year if my drug costs go up?

Generally, no. You can only switch during open enrollment (November-January for Medicare, and November-December for marketplace plans). Exceptions exist if you move, lose job-based coverage, or experience a major life change. If your drug cost spikes unexpectedly, contact your insurer to see if they offer a temporary exception or appeal process. Otherwise, you’ll have to wait.

What if my drug isn’t on the formulary at all?

You have a few options. First, ask your doctor if there’s a similar drug on the formulary. Second, file a formulary exception request with your insurer-they must respond within 72 hours for urgent cases. Third, pay out of pocket if it’s a short-term need. And fourth, consider switching plans next year. Always document your request in writing. Many people don’t realize they can appeal, and end up going without medication.