Why Brand Companies Launch Authorized Generics: Strategy Explained

- Colin Hurd

- 24 January 2026

- 8 Comments

When a blockbuster drug loses its patent, the brand name company doesn’t just sit back and watch its profits vanish. Instead, many of them launch something called an authorized generic-a version of their own drug, sold under a generic label, at a fraction of the price. It sounds counterintuitive. Why would a company undercut its own brand? The answer isn’t about altruism. It’s about control.

What Exactly Is an Authorized Generic?

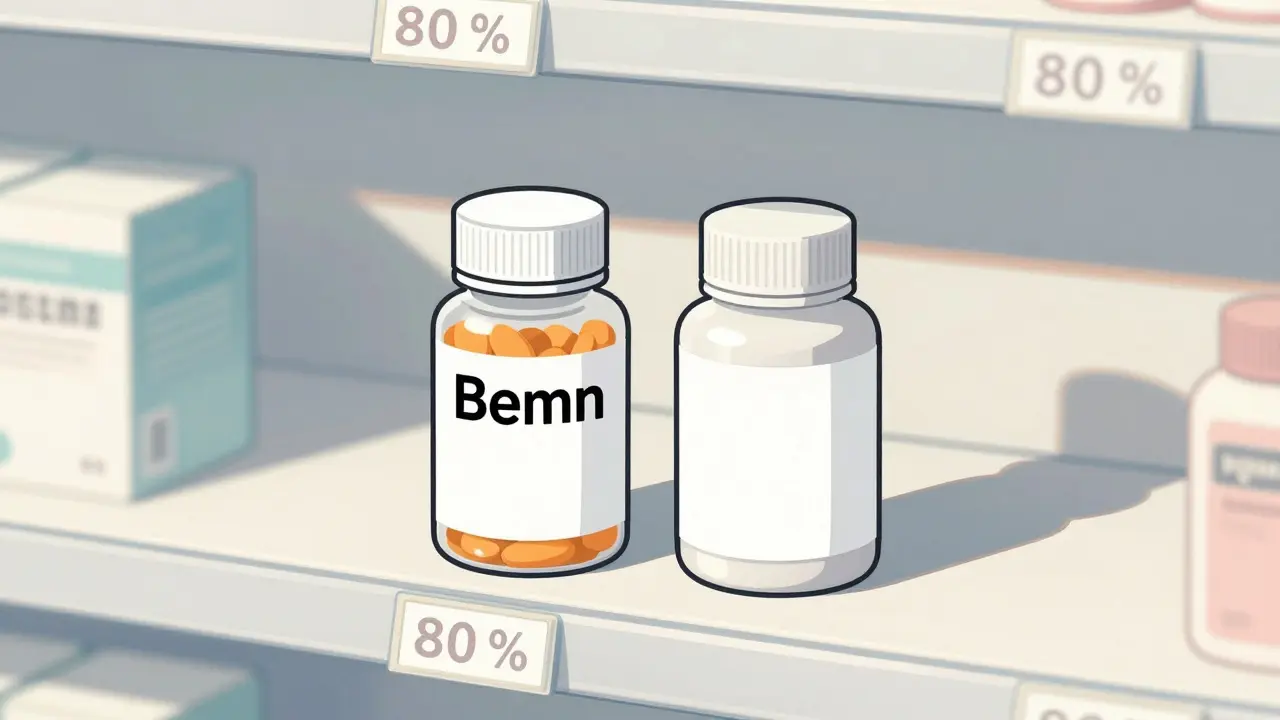

An authorized generic is the exact same pill, capsule, or injection as the brand-name drug. Same active ingredient. Same inactive ingredients. Same manufacturing process. The only difference? No brand name on the label. It’s not a copy. It’s the real thing, just repackaged. Unlike traditional generics, which must prove they’re bioequivalent through the FDA’s Abbreviated New Drug Application (ANDA) process, authorized generics ride on the original brand’s New Drug Application (NDA). That means no new approval is needed-just a simple notification to the FDA. This lets brand companies roll them out fast, often within weeks of a patent expiring. For example, when Pfizer’s Celebrex lost patent protection, its authorized generic, sold under the Greenstone label, hit shelves with the exact same formulation. Same capsule, same coating, same fill. Patients didn’t notice a difference. But the price dropped by 60-80%.Why Do Brands Do This? It’s Not Charity

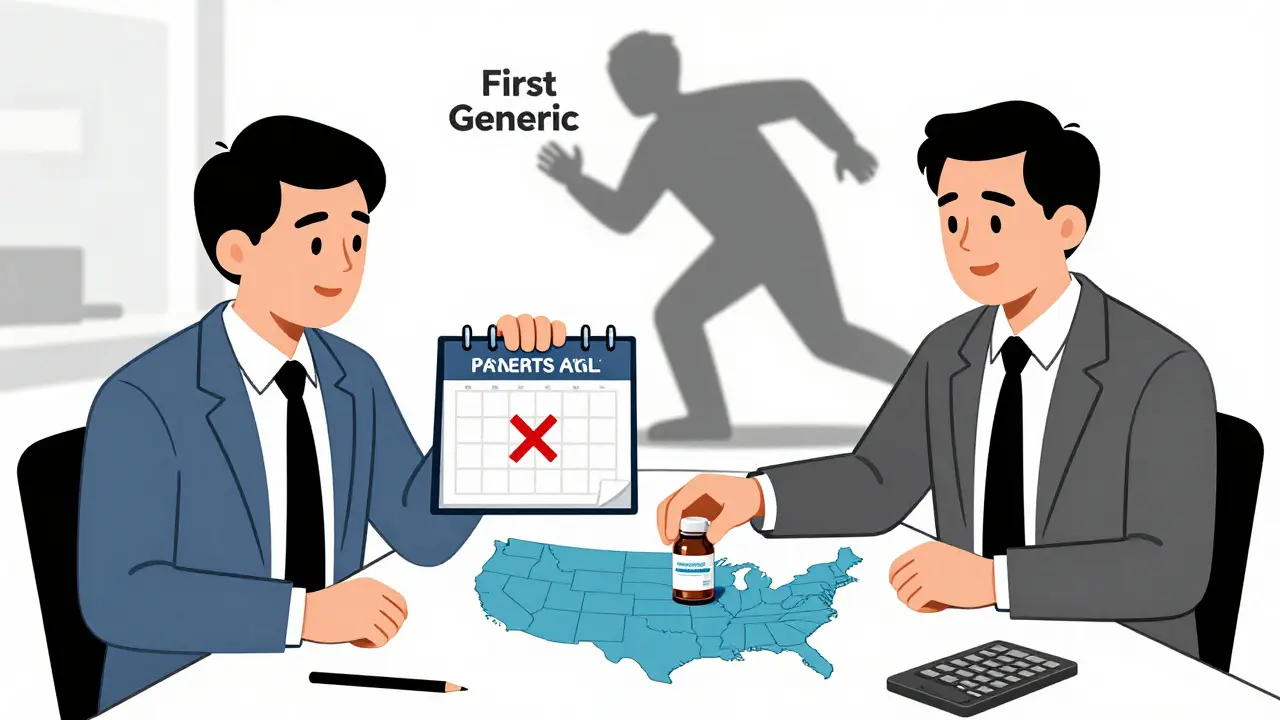

The real question isn’t what an authorized generic is-it’s why a company would create one. The answer is simple: to protect revenue. When a drug’s patent expires, generic competitors move in fast. In the first year, brand manufacturers typically lose 80-90% of their sales. That’s not a slow decline. It’s a cliff. And the first generic to enter the market gets a special advantage under the Hatch-Waxman Act: 180 days of exclusivity. During that window, they’re the only generic allowed. No competition. That means they can charge nearly brand prices-sometimes even higher. That’s where the authorized generic comes in. If the brand company launches its own generic version during that 180-day window, it splits the market with the first generic. Suddenly, the generic company isn’t the only game in town. Prices drop faster. The generic company’s windfall shrinks. And the brand company? It keeps a slice of the action. The Federal Trade Commission found this strategy works. In markets where authorized generics entered during the 180-day exclusivity period, prices were significantly lower than in markets where they didn’t. Consumers won. The first generic company lost its monopoly pricing power. And the brand company? It didn’t lose everything.Splitting the Market: Two Prices, One Drug

This isn’t just about fighting generics. It’s about segmenting customers. Brand companies don’t want to abandon their loyal customers. Some people-especially those with good insurance or who trust the brand-are willing to pay more. Others, especially those paying out-of-pocket or on Medicaid, want the cheapest option. By launching an authorized generic, the company creates two paths:- Brand version: Sold at full price to those who prefer it or can afford it.

- Authorized generic: Sold at discount price to price-sensitive buyers.

Timing Is Everything

The timing of an authorized generic launch isn’t random. It’s calculated. From 2010 to 2019, 75% of authorized generics launched after generic competition had already started. That’s the classic defensive play: wait, see who enters, then respond. But here’s the shift: between 2020 and 2023, more brands started launching authorized generics before any generic appeared. Why? To scare off competitors. If a generic company is planning to enter a market, and suddenly they see the brand’s own generic version already on the shelf, they might rethink their investment. Why spend millions on FDA approval and manufacturing if the brand is already undercutting you? This preemptive move makes the market less attractive to new entrants. It’s like walking into a store and finding the owner already selling their own brand at half price. You might just walk out.Why Authorized Generics Are Different From Regular Generics

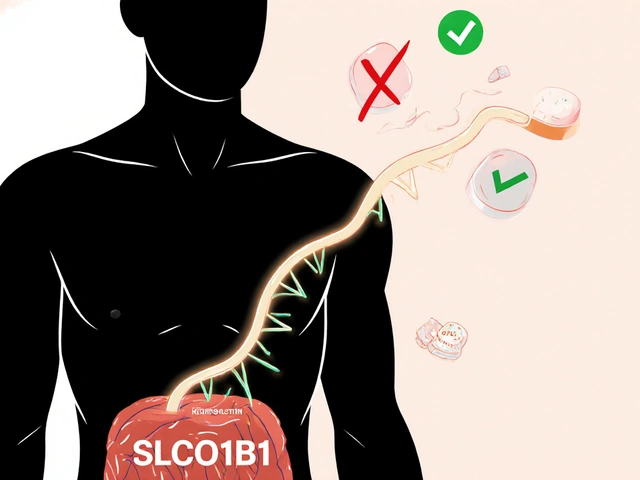

Not all generics are created equal. Traditional generics only need to match the brand’s active ingredient. Inactive ingredients-like fillers, dyes, or coatings-can be different. For most drugs, that doesn’t matter. But for drugs with a narrow therapeutic index-like warfarin, levothyroxine, or seizure meds-even small changes can affect how the body absorbs the drug. Patients on these drugs often have bad experiences switching to a generic. Seizures return. Blood thinners don’t work right. Doctors get nervous. Authorized generics eliminate that fear. They’re identical. No guesswork. No risk. That’s why patient surveys show over 80% of Americans want the option to choose an authorized generic over a traditional one. They know they’re getting the same drug they’ve always trusted.

The Bigger Picture: What’s Next?

This strategy isn’t going away. It’s getting smarter. Some companies now sell authorized generics only through mail-order pharmacies or specific chains to avoid direct price comparisons with the brand. Others bundle them with loyalty programs or insurance discounts. The goal? Keep the brand image strong while capturing the discount market. And it’s spreading. The same logic is now being tested with biologics-complex drugs like Humira and Enbrel. These drugs don’t have generics. They have biosimilars. But what if the brand company launched its own “authorized biosimilar”? The FDA hasn’t ruled on it yet. But the market is watching. The bottom line? Authorized generics aren’t a sign of weakness. They’re a sign of control. Brand companies aren’t giving up. They’re adapting. They’re playing chess, not checkers.What This Means for You

If you’re a patient: ask your pharmacist if an authorized generic is available. You might get the same drug at a much lower price-with no trade-off in quality. If you’re a prescriber: know that authorized generics offer continuity of therapy. For patients on sensitive medications, this can mean fewer side effects and better outcomes. If you’re a payer or insurer: authorized generics help control costs without sacrificing efficacy. They’re a win-win. This isn’t about tricking consumers. It’s about giving them more choice. And in a system where drug prices are under scrutiny, that’s a rare kind of transparency.Are authorized generics the same as brand-name drugs?

Yes. Authorized generics contain the exact same active and inactive ingredients as the brand-name drug. They’re made in the same factory, on the same lines, using the same formula. The only difference is the label. They’re not copies-they’re the real thing, sold without the brand name.

Why are authorized generics cheaper than the brand version?

They’re cheaper because they don’t carry the marketing, advertising, and R&D costs associated with the brand name. The manufacturer doesn’t need to spend money on TV ads, patient support programs, or doctor promotions. The cost savings are passed directly to the consumer.

Can I trust an authorized generic as much as the brand?

Absolutely. Because they’re made by the same company using the same process, authorized generics are often more consistent than traditional generics. For drugs where small changes in formulation can affect effectiveness-like thyroid meds or blood thinners-authorized generics are the safest switch.

Do authorized generics reduce the price of other generics?

Yes. When a brand company launches its own generic version, it forces other generic manufacturers to lower their prices too. The Federal Trade Commission found that in markets with authorized generics, overall drug prices dropped significantly during the first 180 days after patent expiry. That’s good for consumers and payers.

Why don’t all brand companies launch authorized generics?

It’s a strategic decision. Some companies prefer to let the market shift fully to generics and focus on new drugs. Others lack the manufacturing capacity or don’t see enough profit potential. But for high-volume, high-margin drugs-especially those with narrow therapeutic windows-authorized generics are now the standard move.

Comments

Nicholas Miter

Kinda wild how the pharma giants play the long game. You think they’re giving up, but they’re just reshuffling the deck. Authorized generics? More like a velvet hammer.

January 25, 2026 AT 03:43

Suresh Kumar Govindan

This is a calculated erosion of market integrity. The regulatory framework has been subverted by corporate strategy. The FDA’s role has been reduced to a rubber stamp for profit-driven deception.

January 25, 2026 AT 14:48

TONY ADAMS

so like… they just slap a different label on the same pill and call it a day? lol. genius.

January 26, 2026 AT 06:48

Josh josh

bro the fact that they make the exact same thing but call it generic just to drop the price is next level capitalism. i get it but also i wanna cry

January 26, 2026 AT 16:41

bella nash

One must consider the ethical implications of price discrimination in healthcare. While economically rational, the moral architecture of such a system remains fundamentally unbalanced.

January 27, 2026 AT 17:24

Geoff Miskinis

Let’s not pretend this is consumer-friendly. It’s a monopolistic maneuver dressed in the clothing of competition. The FTC’s findings are a polite euphemism for collusion.

January 28, 2026 AT 19:26

Sally Dalton

OMG I just asked my pharmacist about this yesterday and she was like ‘oh yeah we have the green bottle version’ and it was half the price!! i felt so smart 😭 thank you for explaining this so clearly!!

January 29, 2026 AT 18:47

Shawn Raja

So the brand company didn’t lose the patent… they just renamed it and gave themselves a seat at the table. Classic. Meanwhile, the rest of us are just trying to afford our meds without selling a kidney. 🙃

January 30, 2026 AT 21:01